Switzerland: Europe’s Business-Friendly Tax Haven

Switzerland continues to be one of the world’s most appealing destinations for entrepreneurs and investors — combining political stability, a strong economy, and transparent tax policies.

Thanks to the federal system, each canton sets its own corporate tax rates, allowing businesses to choose their location based on the most favorable fiscal environment.

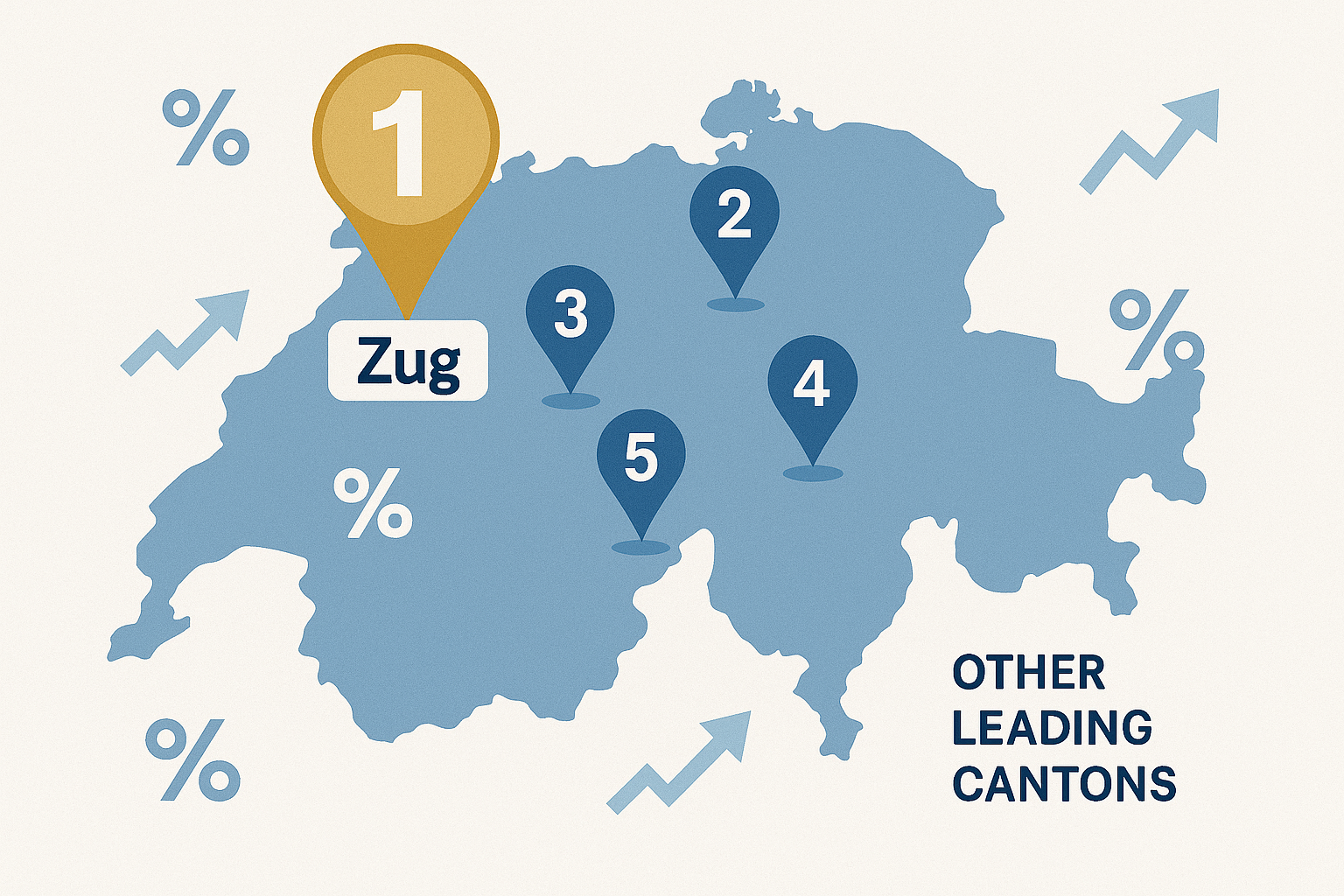

In 2025, the lowest corporate tax rates in Switzerland are again found in several central and eastern cantons — with Zug leading the list for yet another year.

1. Canton of Zug – The Benchmark for Low Taxes and High Standards

With an effective corporate tax rate of approximately 11.9%, Zug remains Switzerland’s most business-friendly canton.

It’s not just about low taxes — Zug offers credibility, international prestige, and access to world-class financial, legal, and accounting experts.

What makes Zug stand out:

- Very low total tax rate (around 11.9%)

- Strategic location between Zurich and Lucerne

- Leading global hub for fintech and blockchain companies

- Efficient and supportive local administration

- High quality of life and professional environment

For companies seeking a registered business address in Switzerland, Zug provides the perfect mix of prestige and efficiency.

👉 Explore our Swiss Business Address Services to establish your official company domicile in Zug — complete with mail handling, legal compliance, and administrative support.

2. Canton of Nidwalden

Nidwalden remains one of the most attractive cantons for holding and intellectual property companies.

Its effective corporate tax rate is around 11.9–12.1%, and it offers generous tax deductions and patent box incentives.

3. Canton of Lucerne

Lucerne has steadily improved its tax competitiveness in recent years.

In 2025, its corporate rate stands around 12.3%, making it ideal for SMEs seeking affordable taxes with excellent access to central Switzerland’s infrastructure.

4. Canton of Schwyz

Schwyz combines moderate tax levels (around 12.4%) with a strong business reputation.

It’s especially popular among financial service providers and trading companies that value proximity to Zurich and Zug.

5. Canton of Appenzell Ausserrhoden

Appenzell AR is known for its simplicity and flexibility.

With rates between 12.5–12.7%, it provides a cost-effective option for smaller businesses that want a Swiss presence without high administrative costs.

Why Zug Is Still the Clear Winner

Zug remains the benchmark canton not only because of its low taxes, but also for its well-organized administrative system, international reputation, and supportive business ecosystem.

At SwissFirm, we help clients establish and manage their Swiss companies efficiently — including complete support with domicile setup, accounting, and director representation.

Our key services include:

With our expertise, you can launch or relocate your company to Switzerland seamlessly — and benefit from Zug’s internationally recognized advantages.

Conclusion

Switzerland’s decentralized tax system continues to empower entrepreneurs with real choices.

In 2025, cantons such as Nidwalden, Lucerne, Schwyz, and Appenzell AR all offer excellent conditions — but Zug remains the clear number one for business domicile, stability, and low taxation.

Start Your Swiss Company With SwissFirm

Looking to establish your business in Zug or another low-tax canton?

SwissFirm offers comprehensive formation, domiciliation, and accounting services — all in one place.

📍 SwissFirm (RB Swiss Group GmbH)

Blegistrasse 7, CH – 6340 Baar

📞 +41 41 410 61 61