Tax Snapshot

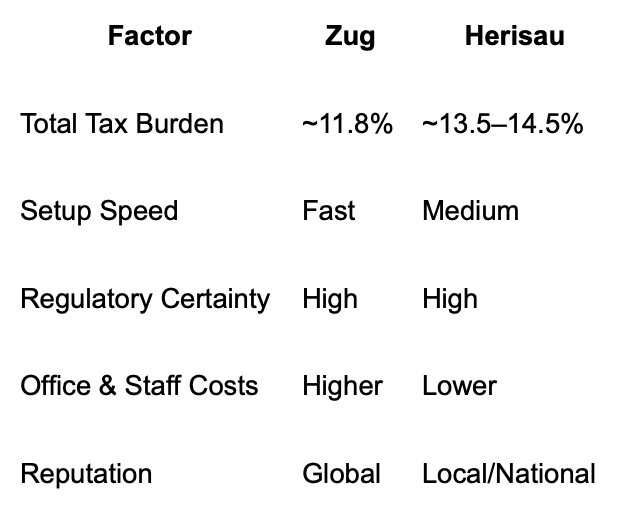

Switzerland is well-known for its stable tax structure, but choosing the right canton is essential. Zug is widely regarded as the most tax-efficient jurisdiction, with total corporate tax rates starting at just 11.8%. Herisau, part of Appenzell Ausserrhoden, offers competitive rates between 13.5% and 14.5%, along with lower overhead costs.

Strategic Differences

Zug appeals to businesses seeking prestige, investor appeal, and seamless international operations. Herisau is best for efficient, low-cost setups for digital firms, consultants, or SMEs.

Best-Fit Business Profiles

Zug:

Herisau:

Legal Requirements and Support

Swiss law requires:

Our domicile services help you meet these needs while ensuring full compliance. Visit our homepage to learn more. You can also explore official federal guidance on company formation and director responsibilities at the Swiss government SME portal.

We offer:

Conclusion

Choosing Zug means investing in a global image and ultra-efficient tax structure. Opting for Herisau is smarter if you're bootstrapping or targeting domestic markets.

Get Advice Today

Not sure what works best for your company? Our team will help you assess the options and provide a custom plan.

✅ Contact Block

SwissFirm.ch

🌐 Website: https://swissfirm.ch

📞 Phone: +41 (0)41 410 61 61

📧 Email: info@swissfirm.ch

🏢 Address: Blegistrasse 7, 6340 Baar, Switzerland

Best-Fit Business Profiles

Zug:

- Financial and Crypto Companies

- International Traders

- Digital Asset Managers

Herisau:

- Small Business Owners

- Lean Startups

- Service Agencies

Legal Requirements and Support

Swiss law requires:

- A registered company address

- A Swiss resident director

Our domicile services help you meet these needs while ensuring full compliance. Visit our homepage to learn more. You can also explore official federal guidance on company formation and director responsibilities at the Swiss government SME portal.

We offer:

- Business setup support

- Legal representation

- Mail and payment handling

- Communication with Swiss institutions

Conclusion

Choosing Zug means investing in a global image and ultra-efficient tax structure. Opting for Herisau is smarter if you're bootstrapping or targeting domestic markets.

Get Advice Today

Not sure what works best for your company? Our team will help you assess the options and provide a custom plan.

✅ Contact Block

SwissFirm.ch

🌐 Website: https://swissfirm.ch

📞 Phone: +41 (0)41 410 61 61

📧 Email: info@swissfirm.ch

🏢 Address: Blegistrasse 7, 6340 Baar, Switzerland